Data Modernisation

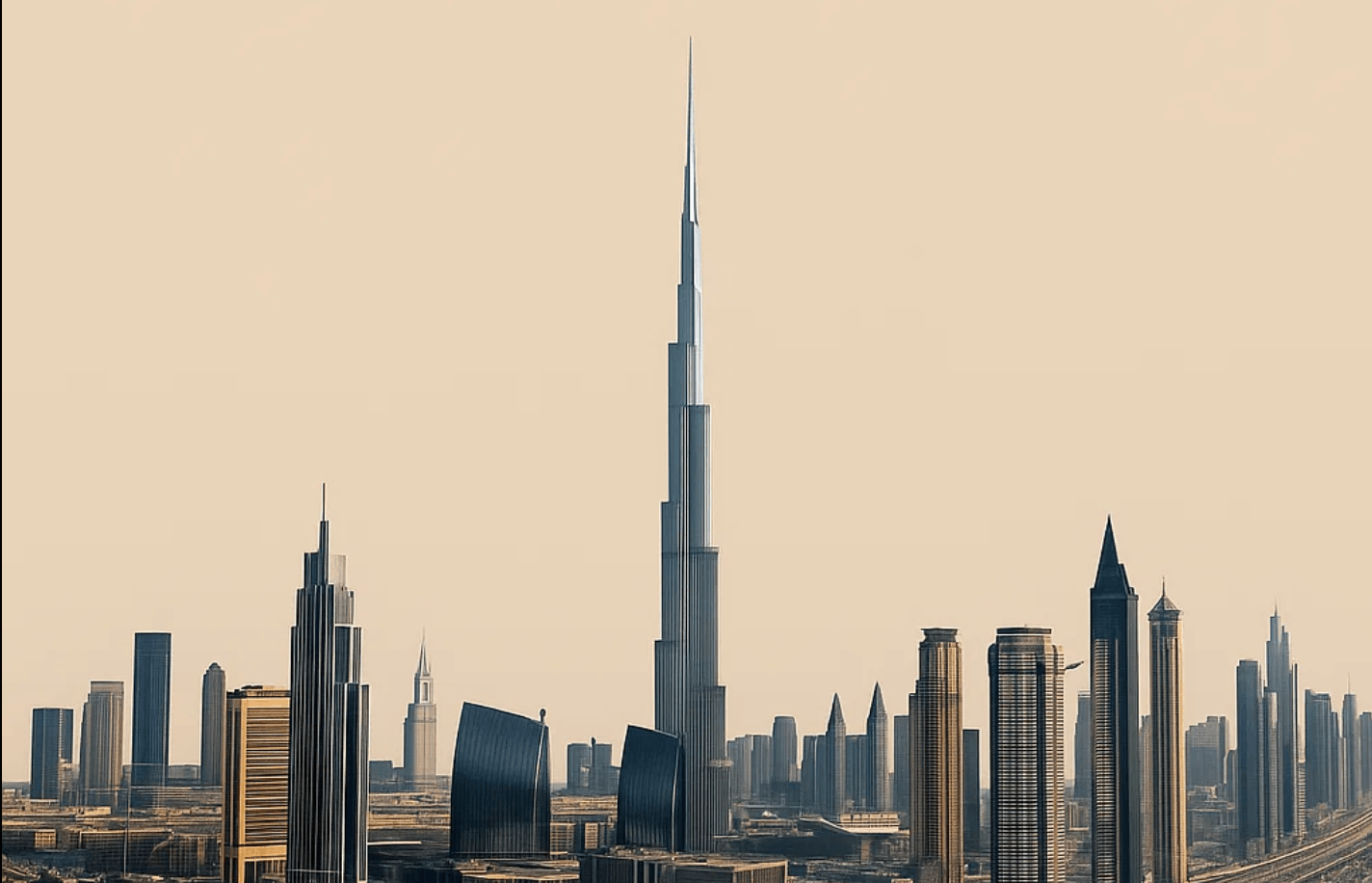

A UAE investment consortium replaced siloed spreadsheets with a secure data platform delivering live reporting on demand.

Crafted in partnership with Confidential UAE Investment Consortium.

Project Goal

Break down data silos and give portfolio leaders accurate insight on demand while meeting regional compliance expectations.

Design Brief

Create a calm executive workspace with Alveus blues and metallic accents that signals trust and speed.

Technologies Used

- Azure Synapse

- Databricks

- Power BI

- Azure Purview

- Azure Active Directory

- Terraform

The Challenge

The investment consortium relied on country specific spreadsheets, email attachments and siloed CRM exports. Analysts spent nights reconciling numbers before board meetings and risk teams could not see exposure in one place.

Key Challenges

Portfolio performance data lived in six regional databases with conflicting formats

Finance, risk and investor relations all used different versions of the truth

No standard backup policy left leadership anxious about audit readiness

Report refreshes required manual SQL pulls and fragile macros

Sensitive data lacked consistent access controls and masking

The Solution

We orchestrated a secure lakehouse pattern so every team works from trusted data sets with controlled lineage and rapid recovery.

Key Features

Core functionalities we implemented

Azure Synapse pipelines collecting source data into Delta tables with quality checks

Databricks notebooks delivering transformation logic and reusable investment models

Power BI semantic layer serving curated dashboards for executives and portfolio leads

Azure Purview catalogue maintaining lineage, classifications and data ownership

Terraform managed infrastructure codifying networks, security groups and backup policies

Development Process

Step-by-step implementation

- 1

Assessed existing exports, databases and spreadsheets to define integration priorities

- 2

Prototyped ingestion from the highest value market feeds and CRM tables

- 3

Implemented data quality scorecards with automated alerts for anomalies

- 4

Rolled out role based access via Azure Active Directory and multi factor prompts

- 5

Trained analysts to build self service reports using governed datasets

Impact Visualised

These performance signals capture how the initiative changed day to day delivery.

Manual report preparation time reduced

Quarterly packs now refresh automatically with governed datasets.

Data sources connected

Core banking, CRM, market feeds and risk models now sit in one trusted hub.

Recovery point objective

Automated backups mean leaders can restore critical insight within a quarter hour.

The Results

Leadership now requests insight knowing the data is timely, complete and protected. Teams answer investor questions on demand without waiting for overnight jobs.

Investment Intelligence

Eighteen data sources run through a governed model with lineage and stewardship documented.

Board Reporting

Power BI dashboards refresh before every meeting, freeing analysts for strategic work.

Minute Recovery

Geo redundant backups and scripted failover deliver confidence for regulators and partners.

Ready to Create YourSuccess Story?

Let's discuss how we can help you achieve similar results. Our team is ready to create a tailored solution for your specific needs.